So I hope you have already guessed what today’s newsletter would be about, but if you haven’t…

Let’s talk about what this means

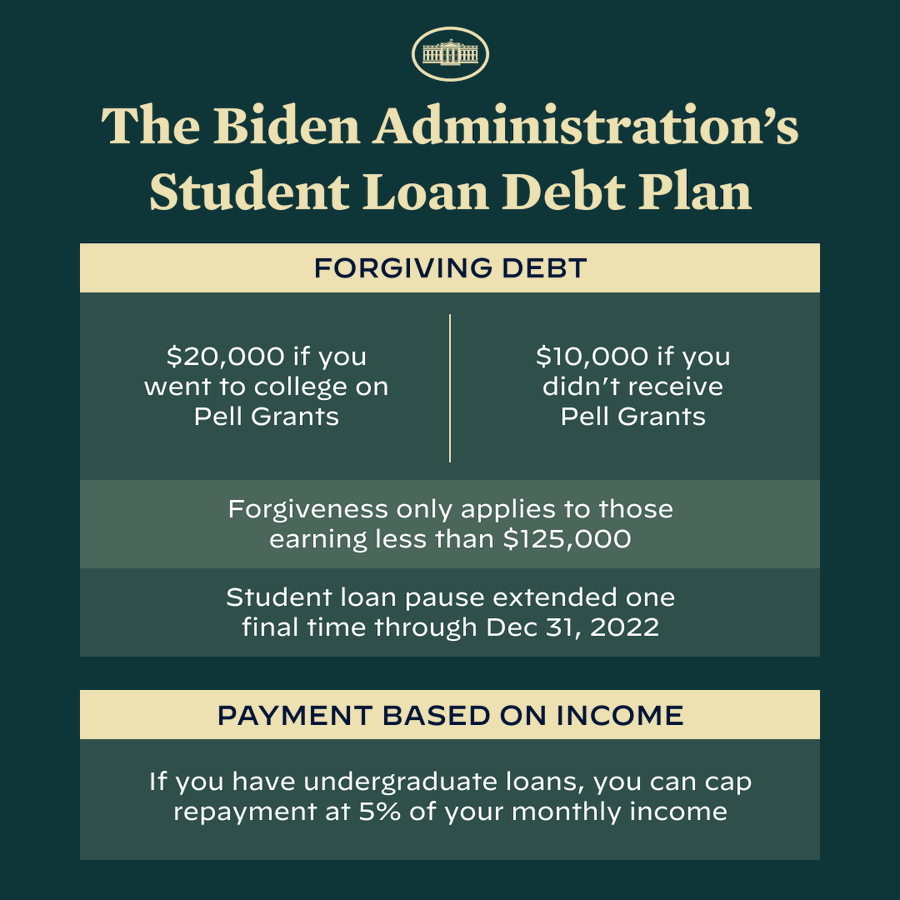

First and foremost, this loan forgiveness only applies to those with federal student loans. Anyone with private loans, i.e. loans not financed by the federal government, are not eligible for loan forgiveness. Furthermore, there are income limits. Only individuals making less than $125,000 or a married couple filing jointly making less than $250,000 a year are eligible. Your income amount is based on either tax year 2020 and/or 2021.

Those who accumulated federal student loan debt and received Pell Grants will be eligible for $20,000 in forgiveness, while those who did not receive Pell Grants will be eligible for the standard $10,000.

The relief includes loans obtained on June 30th, 2022 and before.

At this point, it does not look like any action will need to take place on behalf of the borrower to claim this relief. However, you may want to make sure that your income has been entered into the Department of Education’s website. You can sign up here to be notified when the income application opens. Be sure to select “Federal Student Loan Borrower Updates.”

Parent PLUS loans do apply as well, but it is important to note that income limits still apply. The debt relief does apply to current students as well who currently have outstanding student loans.

Student loan debt will not be treated as income, meaning you will not be taxed for it.

Actually, there are some other important nuggets here. The income based repayment program, which caps the amount of your monthly income required to pay student loans each month, drops to 5% now—down from 10% previously. Lastly, loan balances will now be forgiven after 10 years of payment—instead of the previous 20 years—for borrowers with $12,000 or less in debt.

Let’s talk markets—specifically inflation. Some former economic advisors (*cough* Larry Summers) believe Biden’s declaration will increase inflation. However, economists at Goldman Sachs and Moody’s—among others—believe the impact will be minor. It is important to note that payments on federal student loan debt have remained paused for more than 2 years. Plus, unlike stimulus money, consumers are not gaining any cash to spend, but they will be wealthier.

Don’t celebrate quite yet. While Biden’s executive order is law for now (but Executive Orders technically aren’t laws? someone call a lawyer), don’t rule out a court case. However, the political implications of overruling Biden’s executive order could be dangerous (*cough* Republicans). Additionally, don’t forget there is an election right around the corner. Everything happens for a reason, and the timing is not a mistake.

One Last Thing

We have news (or will have news) on the monetary side as well.1 Jerome Powell, our esteemed Federal Reserve Chair, will be giving a speech in Jackson Hole, Wyoming tomorrow. Investors will be interested in how Powell talks about the economy, specifically inflation. The reason being is Wall Street (and anyone who borrows money) wants to know where interest rates are going. All indications seem to be the Fed will continue raising rates aggressively (50bps to 75bps moves),2 which typically means a slower growing economy leading to lower stock prices and less hiring. However, with inflation still coming in hot last month, the Fed most likely feels it needs to continue hiking. See, important things happen in Wyoming. This one is the most important monetary event so far this year.

Disclaimer: This is not professional and/or financial advice. This content is for informational purposes only. Before making any financial decisions you should do your own research, evaluate your financial situation, and/or consult a financial professional.

For an explanation of fiscal versus monetary policy, see the US Federal Reserve.

For an explanation of bps (basis points), see Investopedia.